Newly released estimates by the National Highway Traffic Safety Administration, a division of the US Department of Transportation, reveal that almost 43,000 people lost their lives to motor vehicle crashes in 2021, a 10.5% increase since 2020 and an 18% increase since 2019. An analysis by CNBC examines why the traffic violence crisis is “a tough problem […]

Traffic Accidents

Data: Almost 43,000 Car Crash Deaths in 2021

Figures released by the National Highway Traffic Safety Administration, a division of the US Department of Transportation, show that almost 43,000 people died of traffic violence in 2021. The NHTSA’s estimates suggest that 42,915 lost their lives in motor vehicle crashes last year, up 10.5% from 38,824 in 2020. This makes 2021 the deadliest year for the […]

Are Dusk and Dawn Car Accidents Accurately Counted?

These measures include street lighting, reflective strips on signs, and larger and more visible signage. According to Evari, Federal Highway Administration data show that more street lighting can significantly mitigate nighttime collisions at rural and urban intersections and on highways, helping prevent injuries among both pedestrians and motorists. As a report by Streetsblog notes, 76% of pedestrian […]

Will 24/7 Speed Safety Cameras Save Lives in NYC?

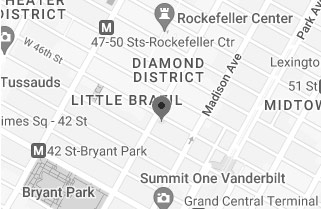

A recent publication by safe transit advocacy group Transportation Alternatives argues that a New York state law preventing New York City from operating speed enforcement cameras on nights and weekends is a contributor to the epidemic of traffic violence afflicting the city. According to the organization’s data, “59 percent of traffic fatalities occur at times when the […]

Reports: NYC Suffers Eight Car Crash Deaths in Four Days

The epidemic of traffic violence in New York City continued last week, with at least eight deaths from traffic accidents in four days, according to a report by Spectrum News NY. Advocacy group Transportation Alternatives, which tracks traffic violence in the city, said data shows a “13% increase year over year in traffic fatalities,” with city […]

Do Bicycle “Stop-to-Yield” Laws Reduce Injuries?

A new resource published by the National Highway Transportation Safety Administration, a division of the Department of Transportation, highlights the benefits of bicycle “stop-as-yield” laws, which allow cyclists to treat stop signs as yield signs: first stopping, then proceeding through the intersection when safe. According to the NHTSA, these laws are correlated with decreased crashes […]

NHTSA Taking Steps to Make Cars Safer for Pedestrians

A recent column in America Walks argues that the US Department of Transportation should take regulatory steps to ensure that large vehicles associated with higher pedestrian deaths implement technology designed to keep pedestrians safe. The National Highway Traffic Safety Administration, a division of the NHTSA, has initiated a rule-making process that would rate passenger vehicles for pedestrian […]

Does Highway Safety Signage Actually Reduce Car Crashes?

A new study suggests that some measures intended to reduce traffic accidents may have the counterintuitive effect of increasing them. According to a recent report by the Los Angeles Times, researchers at the University of Minnesota and the University of Toronto looked at the impact of highway safety signage in Texas—specifically, signs displayed every January notifying drivers of […]

Data: 2022 Another Deadly Year on NYC Streets

The first three months of 2022 were the deadliest on New York City’s street since former mayor Bill de Blasio launched the Vision Zero plan to eliminate traffic violence in 2014, according to data analyzed by Transportation Alternatives. During those months, 59 people lost their lives in motor vehicle accidents, a figure that represents a 44% […]

Understanding the Dangers of Driving While High

Two recent articles discussed the dangers of driving while under the influence of cannabis, as well as broader policy discussions surrounding the issue. In the New York Times, a health columnaddressed whether driving while high is as dangerous as driving while drunk. The column argued that the question isn’t quite as clear-cut as drunk driving, which […]

E-Bike Accident Statistics: E-Bikes May Cause More Injuries than Motorcycles, Cars

Using an electric bicycle or e-bike is more likely to result in injury than using a motorcycle or car, according to a recent UCLA study. However, the study found, those injuries were “less serious than those victims of motorcycle and car crashes, and significantly less deadly.” As a report by Electrek explains, the study involved a review […]

NHTSA Raises Awareness of Distracted Driving Injuries, Deaths

The National Highway Traffic Safety Administration, a division of the Department of Transportation, launched a campaign raising attention to the dangers of distracted driving. As a recent release by the agency notes, April is “National Distracted Driving Awareness Month,” and the NHTSA marked the occasion with a weeklong enforcement effort intended to stop drivers who were texting […]

Reports: NYPD Van Driver Strikes, Kills Pedestrian in Brooklyn

An NYPD driver struck and killed a pedestrian in Brooklyn last week, according to a recent report by the New York Post, which states that the 53-year-old pedestrian “was believed to be homeless and panhandling” in the painted central median of Eastern Parkway. The driver was at the wheel of a police van that was reportedly […]

Data: Traffic Fatalities Rise in NYC

Public data indicates that New York City traffic fatalities have increased 35% in the first three months of 2022 compared to a similar period in 2021. According to a recent report by the New York Post, New York Police Department figures reflect the deaths of 58 people in motor vehicle accidents, as opposed to 43 people […]

Report: Car Crash Deaths Rose in 2021

This month the Governors Highway Safety Association released its annual Spotlight on Highway Safety report on pedestrian traffic fatalities by state, using preliminary data gathered from State Highway Safety Offices. According to the report, traffic fatalities continued rising through the first six months of 2021, with the GHSA projecting that 3,441 pedestrians lost their lives in traffic […]

New York Bill Would Put New Requirement on Student Drivers

A new bill recently introduced in the New York state legislature would place higher standards on student drivers. Senate Bill 8677, introduced by Senator Andrew Gounardes, would require student drivers to take at least six hours of training under a “certified instructor” before they could be issued a license. According to a report by Streetsblog, […]

NYC Mayor Renews Call For Home Rule over Traffic Enforcement

In a news conference last week, New York City Mayor Eric Adams called for New York’s state government to pass a suite of legislation designed to mitigate rising traffic violence in the city. Joined by city officials, lawmakers from all levels of government, and transit safety activists, he renewed demands for state legislators to give […]

NHTSA Launches Automated Safety Tech Media Campaign

The National Highway Traffic Safety Administration, a federal agency that writes and enforces motor vehicle safety standards, has announced a new media campaign to educate drivers about “the safety benefits of advanced driver-assistance technologies in newer vehicles.” According to a press release issued by the agency, the yearlong campaign will involve $1.25 million in spending […]

Brooklyn Activists Call for Safer Bike Lane in Williamsburg

Brooklyn residents are pressing New York City authorities to protect a bike lane on Williamsburg’s Grand Street with concrete barriers. According to a recent report by Brooklyn Paper, transit safety advocates have sent an open letter to the mayor and the commissioner of the Department of Transportation, arguing that the bike lane’s current protections—plastic bollards—are not enough, […]

How to Reduce Gasoline Dependence? Keep Cars off the Roads

A new analysis by Streetsblog the International Energy Agency’s recent proposal of 10 ways countries around the world can reduce their reliance on gasoline. In brief, the IEA’s 10-point plan argues that advanced nations can reduce oil demand in four months by reducing highway speed limits; working from home up to three days each week; establishing “car-free Sundays in […]

NYC Advocates Applaud New Pedestrian Safety Law but Call for More

A new law recently went into effect in New York City that requires the Department of Transportation to “identify each intersection next to a school that does not currently have a traffic control device” and install one by October 2024, according to a report by Streetsblog. Introduced in 2018 by former City Council member Inez Barron, […]

Car Crashes Kill Two Senior Citizens in Queens

The epidemic of traffic violence continued wreaking havoc in New York City last week, as car crashes killed two senior citizens in Queens. According to Streetsblog, one victim was a 75-year-old woman backed over by an 85-year-old man driving a Mercedes Benz; the other was a 88-year-old man hit and killed by the 52-year-old driver of […]

Data: Car Crash Injuries Still Rising in NYC

New York Police Department statistics analyzed by Streetsblog show dramatically increasing traffic violence in New York City in 2022, with “crashes that cause injuries, total injuries and injuries to pedestrians” all rising by double digits. “The violence on New York City streets,” Streetsblog cautions, “is even worse than you think.” According to data concerning traffic […]

NHTSA Issues Final Rule for Autonomous Vehicles

The National Highway Transportation Safety Administration has issued a final rule designed to “ensure safety of occupants in automated vehicles.” According to a press release by the agency, the new rule serves as an update to existing standards, accounting for vehicles without the same manual controls. As a report by TechCrunch explains, the rule updates “terminology in the Federal […]

Reports: Traffic Fatalities Rise in 2020, 2021

Traffic crashes killed 38,824 people across the United States in 2020, according to data released by U.S. Department of Transportation’s National Highway Traffic Safety Administration. As a press release by the NHTSA states, that figure represents “the highest number of fatalities since 2007.” The overall number of traffic crashes and related injuries declined between 2019 […]